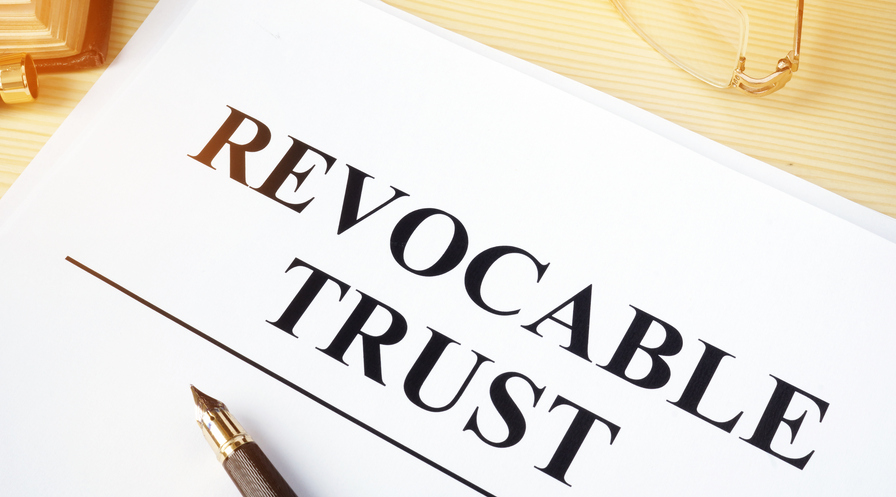

What Is A ‘Revocable Living Trust” And Why You Need One

Just south of ‘Sawmill Creek…..

Hi Attorney Kevin Pritchett here

I conclude this Basic Estate Planning Series with an explanation of the centerpiece of a proper Estate plan…The Revocable Living Trust

“What Is A Revocable Living Trust?”

A Revocable Living Trust (RLT) is a document you sign that provides for the transfer of all the assets in your Estate upon your death.

Most people believe that its the WILL that transfers your assets.. A Will CAN transfer your assets upon your death if a Will is all you have.

Remember, if you have a Will, your heirs are REQUIRED to file that will with the Probate Court of the County where you died and the Probate Legal Process takes over…..a costly and time consuming legal court process where your entire estate is made public and anyone with a possible claim can file a petition with the court and adjudicate that claim.

On the other hand, with a RLT all your estate assets are listed and you provide for any gifts and transfers you wish to make right in the Trust.

The big differences are:

==the RLT is completely private…no court filing

required

==the RLT names a Trustee to handle the affairs of the

RLT…not a court who names an administrator.

==you save time and court expenses

You Can Make Changes To Your RLT

As long as you are alive and mentally competent you can make any changes you want to your RLT.However, once you become mentally incompetent(as determined by provisions of the RLT itself…no court determination required) or die, the RLT provisions become locked in and no changes can be made by the Trustee.

“Ok..But Why Do I Need Revocable Living Trust?”

Glad you asked!! Let’s say you own your personal home and maybe a vacation home. The title to each of these parcels of real estate is you and your spouse in joint tenancy or tenancy by the entirety (which means if one of you dies the surviving spouse has automatic title to the real estate).

The problem with this type of title is…..what if BOTH you and your spouse pass away at the same time..???

Answer: the real estate has no living title owner and the heirs must GO TO PROBATE COURT to sort it out….not good. Expense, delays and possibility of disputes with potential creditors.

ALL of your real estate should be titled in your Revocable Living Trust. The RLT states that both spouses are GRANTORS of the RLT and also provides a Trustee to take over administration of Trust after the last of the two Grantors dies.

Without this RLT in the same situation above, your family would have to file an expensive and time consuming petition with Probate Court for someone to be named administrator or guardian so as to transact your business.

Besides the expense of hiring a Probate Attorney

($2500 to $5,000 minimum Retainer plus ongoing

hourly legal fees), the case could take 12-18 months

to resolve. Add THAT potential cost up at $375/hour or more per hour!!!

Eliminates The Expense And Delay of Probate

Without this RLT

in the same situation above, your family would have to file an expensive and time consuming petition with Probate Court for someone to be named administrator or guardian so as to transact your business.

Besides the expense of hiring me as a Probate Attorney ($2500 to $5,000 minimum Retainer plus ongoing hourly legal fees), the case could take 12-18 months to resolve. Add THAT potential cost up at $375/hour or more!!!

Reach Out To Me If You Have Questions.

If you have comments or questions about any of this…

CLICK HERE to schedule your FREE CONSULTATION

OR

send me an email : ironkop@gmailcom or

if reading on my blog or Facebook page leave your questions or comments below.

Remember…..

“Things Don’t Get Better With Neglect…..”

Kevin Pritchett, Esq

Law Office of Kevin Pritchett, Inc.

www.KevinPLaw.com

ironkop@gmail.com

312-505-1957