Business Structure Part 2: Which Business Entity Structure Is Right For You?

Just south of ‘Sawmill Creek…..

Hi Attorney Kevin Pritchett here

Business Structure Part 2

“Which Business Entity Structure Is Right For You?”

Today, I’ll cover the ‘Sub Chapter S’

Corporation structure. Let’s dive in.

Sub Chapter S Corporation

The most simple corporation structure is the Sub Chapter S Corporation.

Like all corporations, the Sub S gives you :

TAX ADVANTAGES

and

LIMITED LIABILITY.

Pros of Sub Chapter S :

==organizing business activity separately

==provides limited liability. Protects your business

losses and liabilities from your personal assets.

==significant business deductions allowable

== no tax at the corporation level

==income and deductions are ‘passed through’ to the

individual

Cons of SP:

==limited number of shareholders allowed

(100)==shareholders must be individuals (and certain

types of trusts)

==must hold annual meetings and keep corporate

formalities like minutes, resolutions, notice for

meetings etc.

==annual cost to state for annual report filings

Take Home Message For Sub Chapter S

A Sub Chapter S corporation is the easiest

of the entity structures to use. You get to ‘pass through net income ( your gross income subtract business expenses including reasonable salary and what’s left over is what’s taxed…not at a corporate level but at your individual level.

This ‘pass through’ characteristic gives you MUCH greater control over what amount of income is ultimately taxed and in what deductions you have available to offset income.

As opposed to W-2 employee income where you get taxed IMMEDIATELY and you keep what’s left…with a Sub S you deduct off of the gross income and you get taxed on what’s left…huge difference!!!!More money in your pocket !!!

Real Estate Investors and Sub Chapter S

If you own INVESTMENT real estate that you

buy, fix and flip, a Sub Chapter S Corporation is the preferred structure.

For example, the short term gains you make in a ‘fix and flip’ (gains earned in less than 12 months) which are taxed at the highest rate: ordinary income, can be greatly offset by the costs and other business related expenses allowed in a Sub Chapter S

corporation.

Since there is no corporate tax in a Sub S this net income is passed through to your individual tax situation and you pay less tax over all than you would if you earned that same income as a sole proprietor or in another type of corporation that had a tax at the corporate level…make sense?

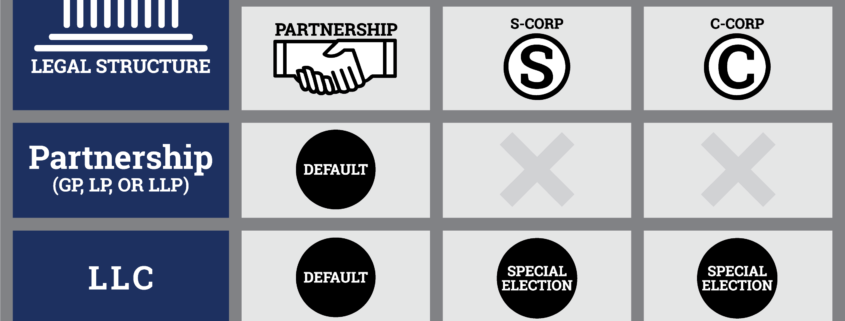

Next time, I’ll go over Limited Liability Companies

Reach Out To Me If You Have Questions.

If you have comments or questions about any of this…send me an email :ironkop@gmailcomor if reading on my blog or Facebook page leave your questions or comments below.

Remember…..

“Things Don’t Get Better With Neglect…..”

Kevin Pritchett, Esq

Law Office of Kevin Pritchett, Inc.

312-505-1957

ironkop@gmail.com

www.KevinPLaw.com

Very nice layout and good content, very little else we require : D.

Glad you liked the post. You can go to http://www.kevinplaw.com and put your email

link in the box on the right. You will be signed up for all my emails and all

my blog content.

Kevin Pritchett, Esq