Can You Afford To Lose 20-30% Of Your Retirement Savings?

Can You Afford to Lose 29-30% Of Your Retirement Savings?

Just south of ‘Sawmill Creek…..

Hi Kevin Pritchett here

Look…I don’t have a crystal ball and I can’t predict the future.

But here’s what I DO Know…..

==NOTHING including the stock market rises forever

==What goes up goes down…eventually

= Stock market losses are THE most devastating factor

on your Retirement Savings….

==It IS Possible To Lock In Stock Market Gains While

Avoiding ALL Stock Market Losses!!

For the last several weeks I’ve explained among other things the importance of having:

==Guaranteed Income For Your Retirement Income

where you can lock in all gains and NEVER suffer

stock market losses…EVER!!!

==a proper Estate Plan (Pour Over Will, Revocable Living Trust, Power of Attorney For Healthcare and Power of Attorney For Property;

==proper insurance coverage for Final Expense, Mortgage Protection and Tax Free Income

I Know You Need A Swift ‘Kick In The Arse’

From over 30 years experience working with clients I KNOW there are times when you need an ‘incentive’ to get off your arse and get things done….

my how you LOVE to procrastinate!!!

‘Black Friday’ Estate Planning/Retirement Income Promotion

So Every year I hold my own ‘Black Friday’ promotion. I’m giving you ‘An Offer You Can’t Refuse’..…

Until Sunday 5 pm I’m offering you $3755 of Estate Planning Insurance Planning and Retirement Income Planning Services for only $585…a GIGANTIC 85% Savings!!

Here’s what you get for this limited time promotion

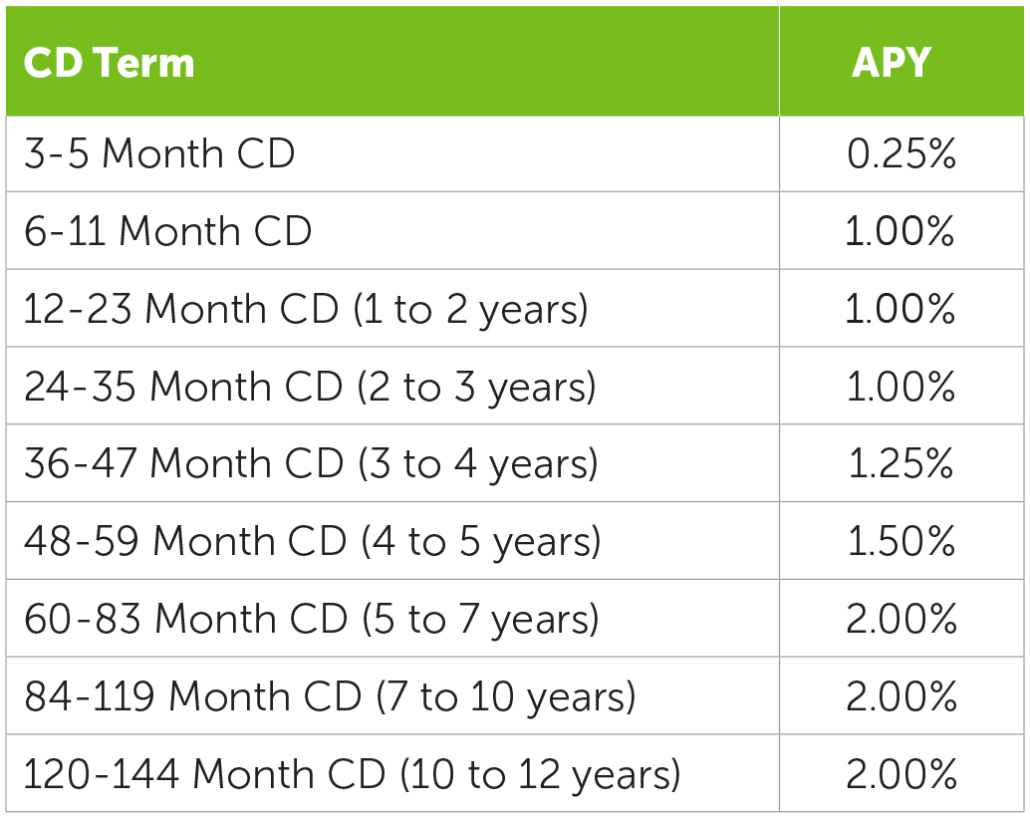

=Retirement Income Analysis

Regular Cost $1,000 Black Friday Cost INCLUDED

==Final Wishes Guide

Regular Cost: $585 Black Friday Cost: INCLUDED

==Life Insurance Review

Regular Cost $585 Black Friday Cost INCLUDED

== IRA/401K Beneficiary Review

Regular Cost: $585 Black Friday Cost INCLUDED

==Complete Basic Estate Plan:

Pour Over will

Revocable Living Trust

Power of Attorney For Healthcare

Power of Attorney For Property

Transfer Title of 1 Personal Home To Trust

Regular Cost: $1085 Black Friday Cost: $585

Total Regular Cost: $3755 Black Friday Cost: $585

CLICK HERE TO LOCK IN YOUR APPOINTMENT

Here’s the Catch(ES)

Great deal right???!!! But there’s a catch..several actually

==CATCH #1

There are ONLY 20 15 APPOINTMENTS AVAILABLE (THIS OFFER IS GOING OUT TO OVER 3,000 PEOPLE. SPOTS GONE EVEN BEFORE EMAIL WENT OUT)

==CATCH #2 OFFER ENDS 5 PM SUNDAY APRIL

14..NO EXCEPTIONS.

To secure your appointment you:

Step 1: CLICK HERE TO LOCK IN YOUR SPOT

Step 2: email me at ironkop@gmail.com and put

‘I Purchased Black Friday Offer’

in subject line

After your payment is made and I receive your email my staff will contact you to schedule your appointment (appointments either in person or by phone..easy peesie right???)

CLICK HERE TO LOCK IN YOUR APPOINTMENT

$3755 of services you KNOW you want and need for only $585…..THIS IS A NO BRAINER!!!

You Miss This…You Lose!!!!

Promotion Ends Midnight Sunday April 14th..NO EXCEPTIONS!!. After the expiration..no whining, no begging…YOU’LL PAY FULL PRICE OR GO WITHOUT!!!

CLICK HERE TO LOCK IN YOUR APPOINTMENT

Remember…..

“Things Don’t Get Better With Neglect…..”

Kevin Pritchett, Esq

Law Office of Kevin Pritchett, Inc.

ironkop@gmail.com

312-505-1957

P.S. $3755 OF Estate Planning, Insurance Planning

and Guaranteed Income Planning For Only

$585!!! ONLY 20 15 Appointments

Available…

OFFER EXPIRES FRIDAY APRIL 14 5 PM..NO

EXCEPTIONS

CLICK HERE TO LOCK IN YOUR APPOINTMENT