Business Structure Part 1: ‘What Business Entity Structure Should You Use?’

Just south of ‘Sawmill Creek…..

Hi Attorney Kevin Pritchett here

Business Structure Part I”Which Business Entity Structure Is Right For You?”

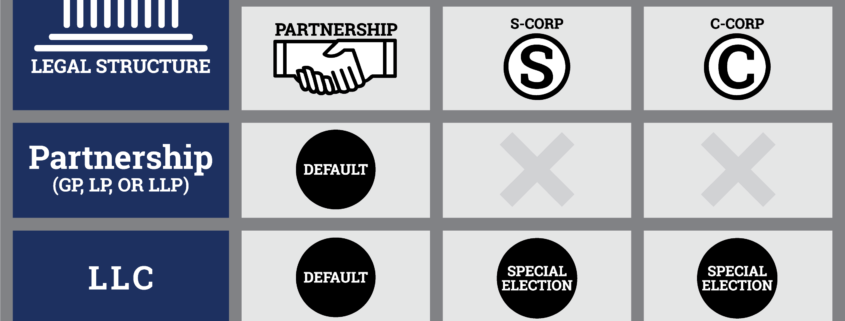

As you can see from the chart above the answer to the “which entity structure’ should I use?” question is REALLY about…..

TAXES

More specifically, saving taxes. Also

PERSONAL LIABILITY

Starting with this newsletter, I will explain each of the business structure types revealing the pros and cons of each focusing on taxes and personal liability.

Today, I’ll begin with ‘Sole Proprietor’ structure. Don’t worry…you won’t have to be a CPA or Tax Geek like me to understand…I’ll keep it super simple and common sense…fair enough? Let’s dive in.

Sole Proprietorship (SP)

SP is the most basic way to conduct

business. You conduct business in your own name (even though you can and should register your sole proprietor business with a dba or ‘Doing Business As’ registration with the County Clerk where you conduct business.

Pros of SP:

==organizing business activity separately

==inexpensive and simple to start==no annual meetings

or other corporate formalities

==limited business tax write offs

Cons of SP:

==not able to claim totality of available business

deductions

==no personal asset protection…i.e. someone can sue

your SP and ALL your personal assets not just the SP

assets are at risk

Take Home Message For SP

A SP is how many people begin operating

business because of its simplicity and low cost.

However, in my opinion (and in my over 30 years of legal practice) the cons of personal liability and limited tax deductions clearly outweigh the cons.

Next time, I’ll go over the different types

of corporations and other entity options.

Reach Out To Me If You Have Questions.

If you have comments or questions about any of this…send me an email :ironkop@gmailcom or if reading on my blog or Facebook page leave your questions or comments below.

Remember…..

“Things Don’t Get Better With Neglect…..”

Kevin Pritchett, Esq

Law Office of Kevin Pritchett, Inc.

312-505-1957

ironkop@gmail.com

www.KevinPLaw.com

This really answered my problem, thank you!

Glad you liked the blog. Let me know what topics you’re interested in

so I can be sure to create content that addresses your issues.

Also, Be sure to sign up for my feed and also leave your email

on the http://www.kevinplaw.com to get all my content.

Best

Kevin Pritchett, Esq